An optimized stacking ensemble technique for creating prediction model of customer retention pattern in the banking sector

DOI:

https://doi.org/10.54117/gjpas.v2i1.29Keywords:

Algorithm, CART, Classification, NN, Model, Prediction, RegressionAbstract

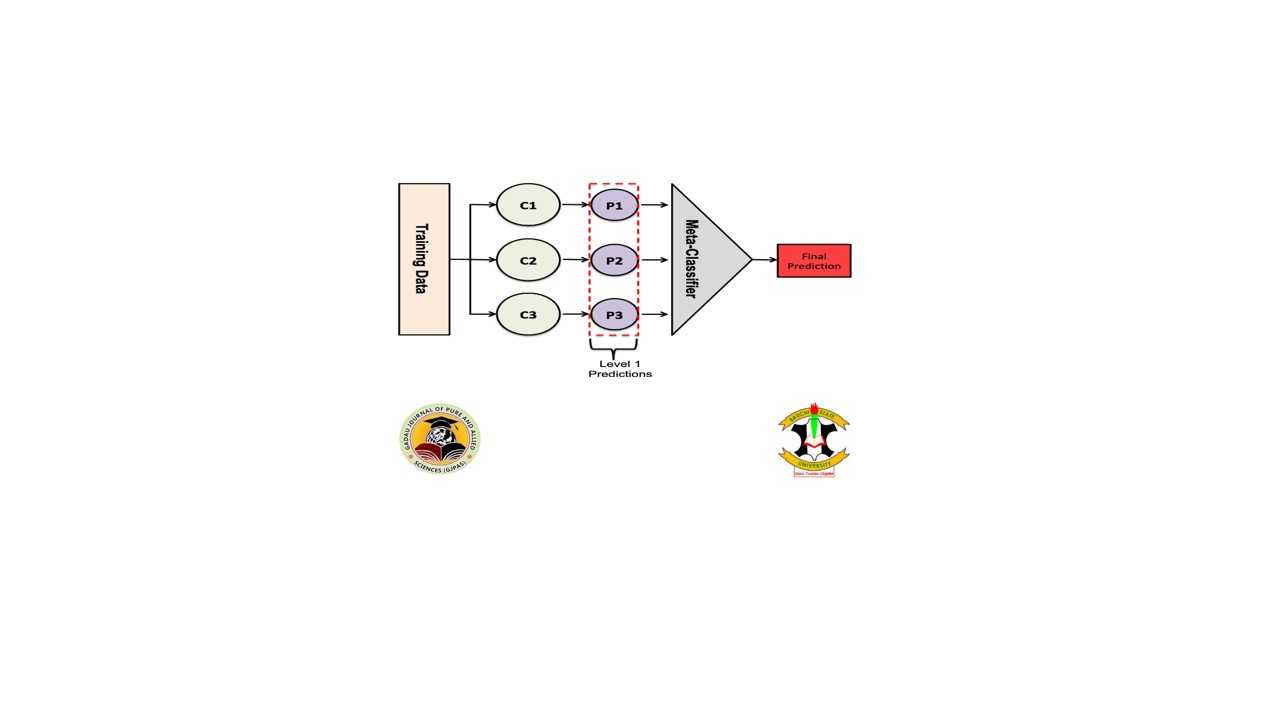

Banking is one of the sectors that pays close attention to their clients’ behavior with a view to tracking their activities, most especially as relates to monetary transactions. To add new customers to the existing fold is not only time consuming, but also expensive. This is why Banks generally would like to do everything within their means to ensure the customer retention pattern is consistently high. The objective of this study, therefore, is to create a prediction model that is capable of predicting the retention rate of bank customers. In other to achieve this central goal, this study proposed a machine learning predictive model, created using a function that combines a number of base classifiers to produce an efficient model. The model was created from the dataset retrieved from an open repository, kaggle. The data basically comprised of some demographic and psychological features and the algorithms implemented on these datasets includes: KNN, CART and Naïve Bayes as base classifiers, while the Logistic Regression was used as the Meta Classifier. The model created was evaluated severally to determine its level of accuracy. The resulting output shows a very high accuracy of 83%. A further comparison of this result with the existing related studies unveils that, the proposed ensemble classifier out-performs the existing model which attains 79% to 81% classification accuracies. The proposed model is reliable and can therefore, be used as a bench-mark for similar models created for the prediction of customer retention pattern within the banking sector.

References

Asgari, M. Taghva, M. Taghavifard, M.T. (2019). Prediction of Bank Customers Partial Churn Using State Chain Model; Business Information Management Studies.

Barween A., Muhammad A., Al-afaishat (2020). Employee retention and organizational performance: Evidence from banking industry, Management Science Letters vol. 10, 3981–3990

Benlan He, Yong Shi, Qian Wan, Xi Zhao, (2018) “Prediction of customer attrition of commercial banks based on SVM model”, Proceedings of 2nd International Conference on Information Technology and Quantitative Management (ITQM), Procedia Computer Science 31 423 – 430.

Burez, J. and Poel, D.V. (2013) Handling Class Imbalance in Customer Churn Prediction. Expert System with Applications, (36), 626-4636.

Chih-Fong Tsai, Yu-sin, (2020) “Customer churn prediction by hybrid neural networks”, Expert Systems with Applications 36 12547–12553.

Galagedera, D. (2014). Modeling Risk Concerns and Returns Preference in Performance Appraisal: An Application to global equity market. Journal of In international financial market institutions; Elsevier.

Guo-en, X., Wei-dong, J.(2018). Model of Customer Churn Prediction on Support Vector Machine. SETP Journal Title, 28(1), 71-77. doi.org/10.1016/S1874-8651(09)60003-X

Gupta, S, D. Hanssens, B. Hardie, W. Kahn, V. Kumar, N. Lin, N. Ravishanker, and S. Sriram . (2015) "Modeling customer lifetime value," Journal of Service Research, 9 (2), 139.

Hashmi, N., N.A. Butt, M. Iqbal, (2016). Customer churn prediction in telecommunication in a decade review and classification. Int. J. Comput. Sci. Issues (IJCSI) 10(5), 271–281.

Kaderabkora, P. Malecek, (2015) Churning and labor market flow in the new EU member states. Int. Inst. Soc. Econ. Sci. 372–378.

Keramatia, R.Jafari-Marandi, M.Aliannejadi, I.Ahmadian, M.Mozaffari, U.Abbasi, (2018) "Improved churn prediction in telecommunication industry using data mining techniques", Applied Soft Computing Volume 24, Pages 994-1012.

Khan, M. R., Manoj, J., Singh, A., and Blumenstock, J. (2015). BehavioralModeling for Churn Prediction: Early Indicators and Accurate Predictors of Custom Defection and Loyalty. IEEE International Congress on Big Data. 1-4.

Mahajan, V., R. Mishra, R. Mahajan, (2015) Review of data mining techniques for churn prediction in telecom. JIOS 37(2), 183–197.

Mahmoud A. M. (2019). Gender, E-Banking, and Customer Retention, Journal of global marketing; vol 32 (4).

Mishachandar, K.A. Kumar, Predicting customer churn using targeted proactive retention. Int. J. Eng. Technol. 7(2.27), 69–76 (2018)

Mishra K., R. Rani (2017). Churn Prediction in Telecommunication Using Machine Learning; International Conference on Energy, Communication, Data Analytics and Soft Computing, pp 2252 – 2257.

Oyeniyi, A. O., Adeyemo, A. B. (2015). Customer Churn Analysis In Banking Sector Using Data Mining Techniques. African Journal of Computing and ICT, 8(3), 165 - 174.

Sayed, H., A., M., and Kholief, S. (2018). Predicting Potential Banking Customer Churn using Apache Spark ML and MLlib Packages: A Comparative Study. International Journal of Advanced Computer Science and Applications, 9(11).

Shaaban, E., Helmy, Y., Khedr, A., and Nasr, M. (2015). A Proposed Churn Prediction Model. International Journal of Engineering Research and Applications (IJERA), 2(4), 693-697.

Umayaparvathi, V., Iyakutti, K. (2020). Applications of Data Mining Techniques in Telecom Churn Prediction. International Journal of Computer Applications, 42(20), 5-9.

Xie, Y.Y., Li, X., Ngai, E.W.T., and Ying Weiyun.(2014) Customer Churn Prediction Using Improved Balanced Random Forests. Expert Systems with Applications, (36), 5445-5449.

Yan, I, R.H. Wolniewicz, R. Dodier, (2014) Predicting customer behavior in telecommunications. 1094- 7167/04IEEE Published by the IEEE Computer Society.

Downloads

Published

Issue

Section

License

Copyright (c) 2023 Gadau Journal of Pure and Allied Sciences

This work is licensed under a Creative Commons Attribution 4.0 International License.